A Step-by-Step Guide to Starting Your Business in the USA: From Company Formation to Opening a Bank AccountA Step-by-Step Guide to Starting Your Business in the USA: From Company Formation to Opening a Bank Account

Starting a business in the United States can be a thrilling and rewarding endeavor. It involves several steps,from choosing the right business structure to understanding legal requirements and setting up a bank account. This guide provides a detailed overview of the process to ensure a smooth journey from concept to operation.

Step 1: Conceptualize Your Business Idea

The first step in starting a business is having a clear business idea. Research the market,understand your target audience,and refine your business concept. A solid business plan is essential,as it will guide your decisions and can be crucial for securing financing.

Step 2: Choose a Business Structure

The next step is selecting an appropriate business structure. Common options in the US include sole proprietorship,partnership,limited liability company (LLC),and corporation. Each has its own legal and tax implications. Consider consulting a legal expert to determine the best structure for your business.

Step 3: Register Your Business

Once you’ve chosen your business structure,you need to register your business. This typically involves filing paperwork with the state government where your business will operate. The requirements vary by state and business structure.

Step 4: Obtain Necessary Licenses and Permits

Depending on your business type and location,you may need specific licenses and permits to operate legally. Check with your local government and industry-specific agencies to ensure you comply with all regulations.

Step 5: Federal and State Tax Registrations

Register for federal and state taxes. For most businesses,this means obtaining an Employer Identification Number (EIN) from the IRS. You may also need to register for state taxes,such as sales tax or payroll tax.

Step 6: Set Up Business Accounting

Setting up an accounting system is crucial for tracking expenses,managing your budget,and filing taxes. Consider hiring an accountant or investing in accounting software to keep your finances in order.

Step 7: US Company Formation with Bank Account

One of the most critical steps is the US company formation with bank account. Opening a bank account in the name of your business is essential for managing finances,processing payments,and establishing credibility. To open a bank account,you’ll typically need your EIN,business formation documents,and personal identification.

Step 8: Business Insurance

Business insurance protects your company from potential risks and liabilities. Common types of business insurance include general liability insurance,professional liability insurance,and workers’ compensation insurance.

Step 9: Create Your Business Identity

Create a brand for your business,including a business name,logo,and a marketing strategy. Establishing a strong brand identity is key to standing out in the market and attracting customers.

Step 10: Launch Your Business

With all the groundwork laid,you’re ready to launch your business. Develop a launch strategy that includes a marketing plan to reach your target audience effectively.

Conclusion

Starting a business in the USA involves careful planning and attention to legal and financial details. By following these steps,from company formation to opening a bank account,you’ll establish a strong foundation for your business’s success. Remember to seek advice from legal and financial experts throughout the process to ensure compliance and make informed decisions.

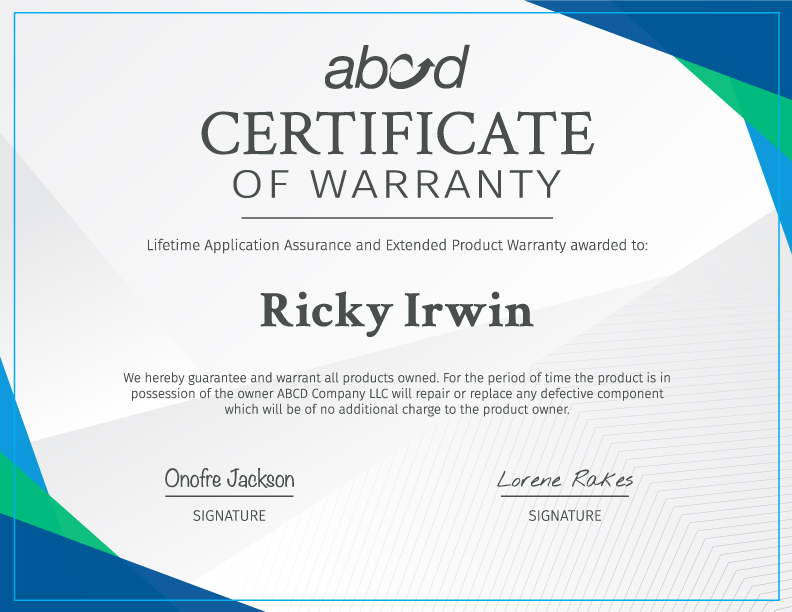

Product Warranty Certificate

Product Warranty Certificate